In Dark of Night Senate Republicans Pass Tax Cuts for the Wealthy Bill Loaded With Pork and Perks

ObamaCare and Medicare Will Suffer

Just before 2 AM in Washington, D.C. Senate Republicans successfully rammed through a bill that will ultimately raise taxes on low-income and moderate-income Americans while delivering long-term tax cuts for the wealthy and for corporations. The final vote was 51-49. No Democrat voted for the nearly 500-pages of legislation that not a single Senator read, as they literally voted to not allow time to read the bill before voting. All but one Republican, Sen. Bob Corker, voted for the bill.

UPDATE: Republicans rejected our motion to adjourn until Monday so senators could read the bill they just introduced.

RT If you think senators should have time to read a bill that affects every single American.

— Sen Dianne Feinstein (@SenFeinstein) December 2, 2017

Here it is: 500 pages of special interest provisions, written in back rooms with lobbyists and no time for senators – let alone the American people – to read it before voting. We need to start over and work together to cut taxes for working people, not corporations. pic.twitter.com/qKjhNIlwgK

— Sherrod Brown (@SenSherrodBrown) December 2, 2017

The legislation will go to conference, where aides will hammer out differences with the House version. Both the House and the Senate will have to vote again on the final bill, but there’s little chance of it not passing through Congress. President Donald Trump is hoping to sign it intro law before Christmas.

What you’re witnessing tonight in the United States Senate is the weaponization of pure, unmitigated greed. Lobbyists are writing the bill in pen at the last minute. And Republicans are no longer even pretending to care about anyone but the super rich. What a shameful night.

— Joy Reid (@JoyAnnReid) December 2, 2017

Democrats eked out one win: Republican Senator Pat Toomey of Pennsylvania tried to give a tax cut to a single institution, Hillsdale college in Michigan. A conservative Christian college that happens to have major ties to the family of Betsy DeVos, Hillsdale “considers itself a trustee of our Western philosophical and theological inheritance.” The Education Secretary and her brother, Erik Prince, are graduates of the school. Prince, the founder of the Blackwater security services company, sits on its board.

Senate Minority Leader Chuck Schumer “called the Hillsdale exemption a ‘metaphor’ for the Republican tax plan,” The Guardian noted.

“A single wealthy college, the pet project of a billionaire campaign contributor to the Republican party exempted by a [senator] who fought to get rid of earmarks,†Schumer said. “This unfortunately is the metaphor for this bill and how high the stench is rising in this chamber as we debate the bill tonight.â€

But Republicans were able to hand their donors a wide array of special gifts, including eliminating a tax on cruise ships that stop in Alaska, and opening the protected Alaska Arctic National Wildlife Refuge to oil drilling. The inclusion of the provision was the only way to get Alaska GOP Senator Lisa Murkowski’s vote on the bill.Â

This should have been an opportunity to work together to cut taxes for working people. Instead Washington chose to cut taxes for corporations that send American jobs overseas, blow a hole in the deficit, & pay for it by cutting Medicare & kicking people off health insurance.-SB

— Sherrod Brown (@SenSherrodBrown) December 2, 2017

The news actually gets worse.

The bill adds at least $1 trillion to the deficit, and repeals the Obamacare individual mandate. 13 million will lose health care coverage under this bill.

In the TAX PLAN they put in

An abortion law reclassifying life at conception.

A clause to drill oil in Alaska’s arctic wildlife preserve.

Pulled the mandate for the ACA.13 million lose insurance

In the TAX PLAN.

We won’t forget. 2018 is gonna be a massacre. #MAGA

— Christopher Titus (@TitusNation) December 1, 2017

“Of the many losers in the tax bill are teachers who will no longer be able to deduct the money they spend out of pocket for their students’ school supplies. And graduate students will see a massive tax increase as a result of a provision to treat their tuition waivers as ordinary income,” an opinion piece in Forbes notes.

“Put simply, this is a direct redistribution of wealth from ordinary Americans to the ultra-wealthy. The non-partisan Tax Policy Center calculated the Trump tax cuts will award 62% of the overall benefit to the top 1% of households. This isn’t just bad economics—it’s morally reprehensible,” the Forbes piece adds.

As an example, it points out that private jet leasing companies, which are actually subsidized by commercial airline flyers – you and me – will benefit from an expansion of this tax subsidy that has been woven into the GOP bill.

Bottom line, the Republican Party has officially exposed themselves as the guardians of the super-rich, the destroyers of the middle class, beholden only to their wealthy donors.

Senate GOP meeting this morning. pic.twitter.com/wFHTRzivFM

— John Aravosis (@aravosis) December 2, 2017

To comment on this article and other NCRM content, visit our Facebook page.

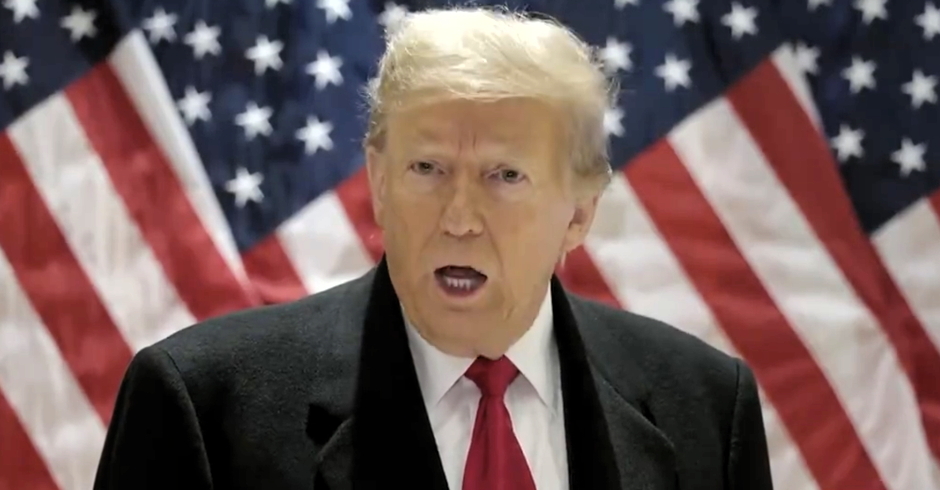

Image by Gage Skidmore via Flickr and a CC license

If you find NCRM valuable, would you please consider making a donation to support our independent journalism?

Â

Enjoy this piece?

… then let us make a small request. The New Civil Rights Movement depends on readers like you to meet our ongoing expenses and continue producing quality progressive journalism. Three Silicon Valley giants consume 70 percent of all online advertising dollars, so we need your help to continue doing what we do.

NCRM is independent. You won’t find mainstream media bias here. From unflinching coverage of religious extremism, to spotlighting efforts to roll back our rights, NCRM continues to speak truth to power. America needs independent voices like NCRM to be sure no one is forgotten.

Every reader contribution, whatever the amount, makes a tremendous difference. Help ensure NCRM remains independent long into the future. Support progressive journalism with a one-time contribution to NCRM, or click here to become a subscriber. Thank you. Click here to donate by check.

|