CRIME

DOJ Slapped Aside Trump Holdovers to Raid Giuliani After Months of Delays: Report

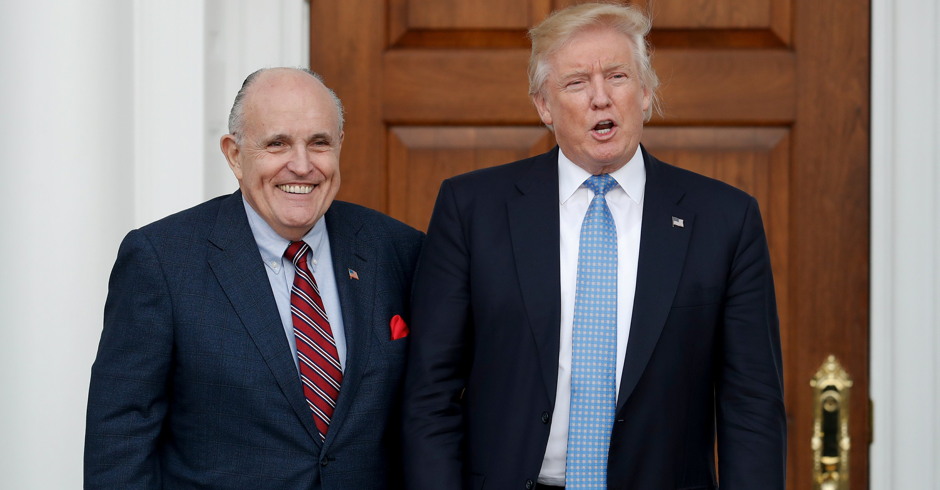

According to a report from NBC/New York, plans to raid the home of former New York City Mayor Rudy Giuliani languished for months in the Justice Department and only came about due to new leadership under President Joe Biden.

On Thursday, the home and office of Giuliani was the subject of a raid with federal agents “collecting phones and computers as part of their probe into whether he broke U.S. lobbying laws by failing to register as a foreign agent related to his work,” the report states.

Those plans had been on hold dating back to the Trump Administration when the Justice Department was headed by Attorney General Bill Barr.

Under the Biden administration — and in particular under newly appointed Attorney General Merrick Garland — the Justice Department is dusting off the files and proceeding with multiple investigations that had stalled out.

According to NBC, “It’s not clear exactly why Justice Department officials chose this particular moment to strike, but it wasn’t out of character for the agency under new Attorney General Merrick Garland. The move was just one in a series of headline-making decisions by a department moving quickly to assert itself in investigations and policy setting,” adding, “The FBI action in New York on Wednesday was especially notable both because of the high-profile nature of the Giuliani investigation and because of the vigorous debate the search warrant question had produced inside the Trump-era Justice Department.”

The report goes on to note that prosecutors were set to go after Giuliani — who had been giving legal advice to former president Donald Trump — last fall but there was infighting within the U.S. Attorneys’ office over the political implications with an election on the horizon.

According to NBC, any dissent about going after Giuliani was pushed aside under the new leadership.

“Prosecutors in New York wanted last fall to serve a warrant on Giuliani as part of an investigation into whether he had failed to register as a foreign agent over his dealings with Ukrainian officials. But that request was rebuffed by officials in the deputy attorney general’s office in Washington. In a dispute over investigative tactics, they raised concerns both before and after the election and did not sign off on a warrant, multiple people familiar with the matter have said,” the report states. “A new leadership team under Garland apparently reached a different conclusion, though it is not clear on what grounds. The new deputy attorney general, Lisa Monaco, and John Carlin, her top deputy, have both previously led the department’s national security division — which is responsible for enforcing the Foreign Agents Registration Act, or FARA — and will presumably be engaged in the investigation as it moves forward.”

The report goes on to note that, under Garland, multiple investigations are moving into high gear “including a tax probe into President Joe Biden’s son, Hunter, and a investigation into potential sex trafficking and public corruption by Florida Rep. Matt Gaetz.”

You can read more here.

Image via Shutterstock

Enjoy this piece?

… then let us make a small request. The New Civil Rights Movement depends on readers like you to meet our ongoing expenses and continue producing quality progressive journalism. Three Silicon Valley giants consume 70 percent of all online advertising dollars, so we need your help to continue doing what we do.

NCRM is independent. You won’t find mainstream media bias here. From unflinching coverage of religious extremism, to spotlighting efforts to roll back our rights, NCRM continues to speak truth to power. America needs independent voices like NCRM to be sure no one is forgotten.

Every reader contribution, whatever the amount, makes a tremendous difference. Help ensure NCRM remains independent long into the future. Support progressive journalism with a one-time contribution to NCRM, or click here to become a subscriber. Thank you. Click here to donate by check.

|