House to Vote Tuesday on 1097 Page Disastrous GOP Tax-Cuts-for-the-Rich Bill

GOP A-OK With Borrowing Cash to Give Richest Americans a Tax Cut

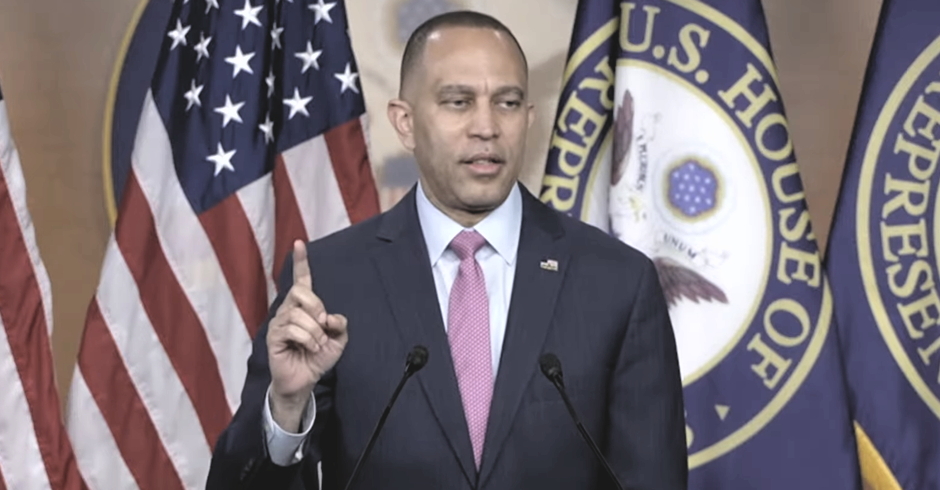

At 5:30 PM on Friday, just ten days before Christmas, Republicans released the text of their extremely unpopular, disastrous 1097 page tax-cuts-for-the rich bill. The House has scheduled a vote on Tuesday. The Senate will vote after that. GOP leaders says they have the votes, thanks primarily to Republican Senators Marco Rubio and Bob Corker.

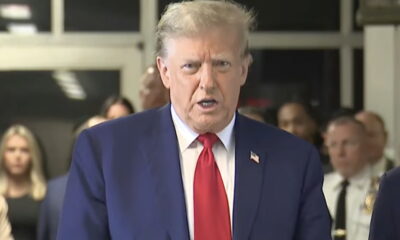

The bill will add $1 trillion to the deficit over the next ten years. So much for the GOP being the party of fiscal conservatism. They are literally borrowing cash to give the richest Americans a tax break.Â

It will also repeal the Affordable Care Act’s individual mandate, leading to an additional 13 million uninsured, and forcing ObamaCare premiums to skyrocket even more than they have thanks to President Trump’s manipulations.

House will vote TUESDAY on tax reform bill per @GOPLeader. pic.twitter.com/fVFgnIIOR7

— Craig Caplan (@CraigCaplan) December 15, 2017

The Washington Post reports “the ‘Tax Cut and Jobs Act’ is the largest one-time reduction in the corporate tax rate in American history: from 35 percent down to 21. The bill also lowers taxes for the vast majority of Americans and small business owners — at least until the cuts expire after 8 years.”

Corporate tax cuts are permanent, individual tax cuts are not.

“Last-minute changes to the GOP’s big plan gave a larger tax break to the wealthy and preserved certain tax savings for the middle class, including the student loan interest deduction, the deduction for excessive medical expenses, and the tax break for graduate students.”

“You can deduct just $10,000 in state, local and property taxes,” the Post adds, warning “there are concerns it could cause property values to fall in high-tax cities and leave less money for public schools and road repairs.”

“Working-class families get a bigger Child Tax Credit,” and, on the other side, “You can inherit up to $11 million tax-free.”

There is still a chance the bill could fail, but that seems increasingly unlikely at the moment.

UPDATE:

The bill, at least portions of it, are retroactive to the beginning of this year.Â

Sure, why not retroactively change the rules on what taxes you’ll owe THIS YEAR. (The one that ends in two weeks.) https://t.co/OFGb4qfJ11

— Justin Wolfers (@JustinWolfers) December 15, 2017

To comment on this article and other NCRM content, visit our Facebook page.

If you find NCRM valuable, would you please consider making a donation to support our independent journalism?

Â

Â

Enjoy this piece?

… then let us make a small request. The New Civil Rights Movement depends on readers like you to meet our ongoing expenses and continue producing quality progressive journalism. Three Silicon Valley giants consume 70 percent of all online advertising dollars, so we need your help to continue doing what we do.

NCRM is independent. You won’t find mainstream media bias here. From unflinching coverage of religious extremism, to spotlighting efforts to roll back our rights, NCRM continues to speak truth to power. America needs independent voices like NCRM to be sure no one is forgotten.

Every reader contribution, whatever the amount, makes a tremendous difference. Help ensure NCRM remains independent long into the future. Support progressive journalism with a one-time contribution to NCRM, or click here to become a subscriber. Thank you. Click here to donate by check.

|