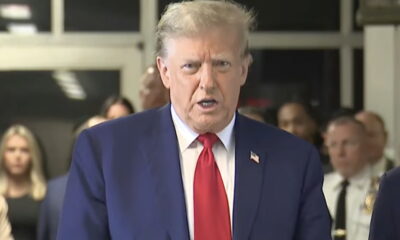

Even Donald Trump Says if Presidential Candidates Won’t Release Tax Returns, ‘Something’s Wrong’

Top Senate Finance Committee Democrat: ‘Releasing Your Tax Returns Should Not Be Optional’

Hillary Clinton and Tim Kaine just released their tax returns – for their 2015 taxes. Clinton had already posted her tax returns going back to 2007, and the Clintons have made their tax returns public since 1977. Kaine also just made his joint tax returns for the past 10 years, going back to 2006 public.

Donald Trump is still actively refusing to release his tax returns, claiming he is under an IRS audit. Trump refuses to provide proof from the IRS that he is under audit, instead providing a letter from his tax attorneys claiming he is under audit. Even if Trump is currently under audit, there is no legal requirement prohibiting him from releasing his tax returns – even billionaire Warren Buffett said he would make his returns public – he says he is also under an IRS audit – if Trump would.

Clinton today via Twitter goaded Trump to release his returns:

Here’s a pretty incredible fact: There is a non-zero chance that Donald Trump isn’t paying *any* taxes. pic.twitter.com/Aefxj6CKCd

— Hillary Clinton (@HillaryClinton) August 12, 2016

Clinton also released a new ad showing Republicans – from Senate Majority Leader Mitch McConnell to Senator Ted Cruz to former GOP presidential nominee Mitt Romney to Donald Trump himself – saying he should release his tax returns. Yes, even Donald Trump says if a candidate won’t show their returns “you would think there is almost like something’s wrong”:

Here’s why Donald Trump might be refusing to release his tax returns: https://t.co/M4MSBonNyo

— Hillary Clinton (@HillaryClinton) August 12, 2016

But Clinton and those Republicans, are far from the only one who want Trump to release his taxes.

67 percent of likely voters, according to the conservative polling organization Rasmussen in a just-released poll, believe presidential candidates should show at least the past year’s tax returns.Â

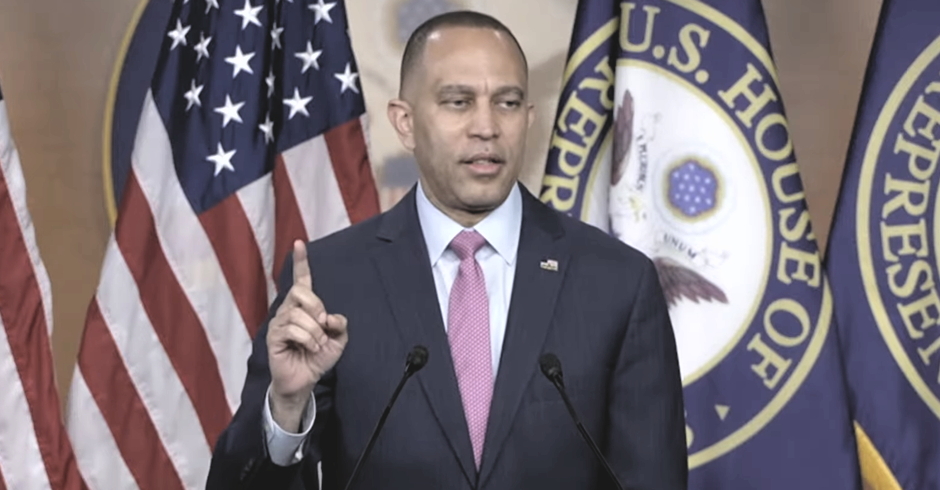

On Thursday Democratic Sen. Ron Wyden, the Ranking Member of the U.S. Senate Finance Committee, also took to Twitter to demand Trump – although he didn’t use his name – release his tax returns.Â

The Presidential Tax Transparency Act would make releasing tax returns a requirement so pres. nominees cannot hide foreign investments

— Senate Finance Cmte (@SenateFinance) August 11, 2016

One more tweet from Sen. Wyden, challenging Senate Majority Leader Mitch McConnell to allow a bill to make it mandatory for presidential candidates to release their taxes:

It’s simple. If @SenateMajLdr is serious about protecting our democracy from foreign influence, he will bring up the bill immediately.

— Senate Finance Cmte (@SenateFinance) August 11, 2016Â

Why must Trump release his taxes?

NPR today has an excellent article explaining exactly why, with a good deal of background, that unsurprisingly includes Richard Nixon. But here’s the gist, excerpted from NPR’s article:

1. Conflicts of interest: Almost every candidate who runs for public office is fairly wealthy. (Even the candidates who have the government pay their salary, like Bernie Sanders and Joe Biden, make far more money than the average American.) Because of that wealth, how they made their money (we’ll get to heart in a second) can tell you if they have potential conflicts of interest – who they made that money from.

2. Do they have heart? Tax returns tell us how much candidates give to charity. The Clintons, as noted above, gave between 8 and 15 percent – or about $15 million total — during that eight-year period. Most of that went through the Clinton Family Foundation, as The Atlantic reported. They also contributed to the Nelson Mandela Foundation, First United Methodist Church and the Humana Challenge golf tournament.

3. Are they like us? Again, these candidates are much wealthier than the average American. Median household income in this country is $53,482, according to the Census. The Clintons made $28 million in 2014 (mostly from speeches). They also live in a posh New York suburb of Chappaqua, where they bought their home for $1.7 million in 1999 just before leaving the White House. (In 2016 money, that appreciates to about $2.5 million.) The average home price in the U.S. in June 2016 was $358,000 (median home price was $307,000).

Now it’s time for more Republicans to demand Trump release his taxes.

Â

Enjoy this piece?

… then let us make a small request. The New Civil Rights Movement depends on readers like you to meet our ongoing expenses and continue producing quality progressive journalism. Three Silicon Valley giants consume 70 percent of all online advertising dollars, so we need your help to continue doing what we do.

NCRM is independent. You won’t find mainstream media bias here. From unflinching coverage of religious extremism, to spotlighting efforts to roll back our rights, NCRM continues to speak truth to power. America needs independent voices like NCRM to be sure no one is forgotten.

Every reader contribution, whatever the amount, makes a tremendous difference. Help ensure NCRM remains independent long into the future. Support progressive journalism with a one-time contribution to NCRM, or click here to become a subscriber. Thank you. Click here to donate by check.

|