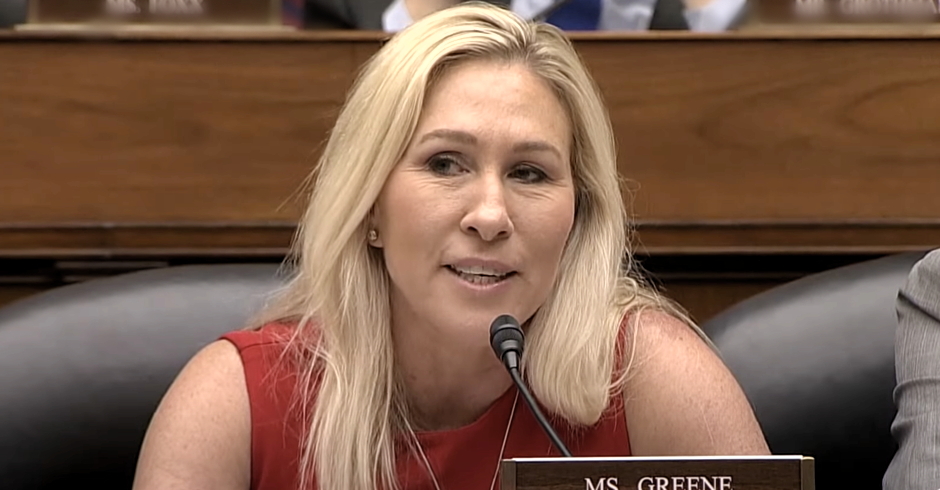

Some House Democrats and House Republicans are coming together toward a common opponent: far-right “pro-Putin” hardliners in the House Republican conference, who appear to be led by U.S. Rep. Marjorie Taylor Greene (R-GA).

Congresswoman Greene has been threatening to oust the Republican Speaker of the House, Mike Johnson. Last month she filed a “motion to vacate the chair.” If she chooses to call it up she could force a vote on the House floor to try to remove Speaker Johnson.

House Democrats say they are willing to vote against ousting Johnson, as long as the Speaker puts on the floor desperately needed and long-awaited legislation to fund aid to Ukraine and Israel. Johnson has refused to put the Ukraine aid bill on the floor for months, but after Iran attacked Israel Johnson switched gears. Almost all Democrats and a seemingly large number of Republicans want to pass the Ukraine and Israel aid packages.

RELATED: Marjorie Taylor Greene, ‘Putin’s Envoy’? Democrat’s Bills Mock Republican’s Actions

Forgoing the possibility of installing Democratic House Minority Leader Hakeem Jeffries as Speaker, which is conceivable given Johnson’s now one-vote majority, Democrats say if Johnson does the right thing, they will throw him their support.

“I think he’ll be in good shape,” to get Democrats to support him, if he puts the Ukraine aid bill on the floor, U.S. Rep. Raja Krishnamoorthi (D-IL) told CNN Thursday. “I would say that there’s a lot of support for the underlying bills. I think those are vital.”

“If these bills were delivered favorably, and the aid was favorably voted upon, and Marjorie Taylor Greene went up there with a motion to remove him, for instance, I think there’s gonna be a lot of Democrats that move to kill that motion,” Congressman Krishnamoorthi said. “They don’t want to see him getting punished for doing the right thing.”

“I think it is a very bad policy of the House to allow one individual such as Marjorie Taylor Greene, who is an arsonist to this House of Representatives,” U.S. Rep. Dan Goldman (D-NY) told CBS News’ Scott MacFarlane, when asked about intervening to save Johnson. He added he doesn’t want her “to have so much influence.”

U.S. Rep. Anthony D’Esposito, one of several Republicans who won their New York districts in 2022, districts that were previously held by Democrats, opposes Greene’s motion to vacate – although he praised the Georgia GOP congresswoman.

CNN’s Manu Raju reports Republicans “say it’s time to marginalize hardliners blocking [their] agenda.”

D’Esposito, speaking to Raju, called for “repercussions for those who completely alienate the will of the conference. The people gave us the majority because they wanted Republicans to govern.”

U.S. Rep. Mike Lawler, like D’Esposito is another New York Republican who won a previously Democratic seat in 2022. Lawler spoke out against the co-sponsor of Greene’s motion to vacate, U.S. Rep. Tim Massie (R-KY), along with two other House Republicans who are working to block the Ukraine aid bill via their powerful seats on the Rules Committee.

U.S. Rep. Mikie Sherrill (D-NJ), a former Navy pilot, blasted Congresswoman Greene.

RELATED: ‘They Want Russia to Win So Badly’: GOP Congressman Blasts Far-Right House Republicans

“Time is of the essence” for Ukraine, Rep. Sherrill told CNN Wednesday night. “The least we can do is support our Democratic allies, especially given what we know Putin to do. To watch a report and to think there are people like Marjorie Taylor Greene on the right that are pro-Putin? That are pro-Russia? It is really shocking.”

U.S. Rep. Dan Crenshaw (R-TX), as NCRM reported Thursday, had denounced Greene.

“I guess their reasoning is they want Russia to win so badly that they want to oust the Speaker over it,” he said, referring to the Ukraine aid bill Greene and her cohorts want to tank. “I mean that’s a strange position to take.”

The far-right hardliners are also causing chaos in the House.

“Things just got very heated on the House floor,” NBC News’ Julie Tsirkin reported earlier Thursday. “Group of hardliners were trying to pressure Johnson to only put Israel aid on the floor and hold Ukraine aid until the Senate passed HR2.”

HR2 is the House Republicans’ extremist anti-immigrant legislation that has n o chance of passage in the Senate nor would it be signed into law by President Biden.

“Johnson said he couldn’t do it, and [U.S. Rep. Derrick] Van Orden,” a far-right Republican from Wisconsin “called him ‘tubby’ and vowed to bring on the MTV [Motion to Vacate.]”

“No one in the group (Gaetz, Boebert, Burchett, Higgins, Donalds et al.) were threatening Johnson with an MTV,” Tsirkin added. “Van Orden seemed to escalate things dramatically…”

Despite Greene’s pro-Putin and anti-Ukraine positions, her falsehoods about “Ukrainian Nazis,” and Russians not slaughtering Ukrainian clergy, reporters continue to “swarm”:

Watch the videos above or at this link.

READ MORE: ‘Afraid and Intimidated’: Trump Trial Juror Targeted by Fox News Dismissed